Must be well-located. This refers to a property’s location in relation to desirable amenities and features, such as good zoning, convenient transportation, good schools, shopping, recreational areas, etc.

Must have minimum in-place multiple of 2X at date of investment. Must have empirical evidence confirming a 2x multipe relative to pricing. We do not pay market pricing.

Must have a recognizable and verifiable plan for development or operation.

Must have favorable slope and soil conditions for development or operation including sensitivity to endangered or protected species of flora and fauna.

Must have sufficient infrastructure (water, power, roads, services), realistic municipal support, proper zoning, ability for entitlement.

Property types can be industrial, agricultural, retail, residential, special use, etc. Properties can also be vacant.

Stonewater is an 800+ acre property in Riverside County (sphere of Indio) that was surrendered by a Canadian billionaire in the Great Recession of ’08. It became an REO which travelled from one failed bank to another before it ended up at a Connecticut hedge fund who sold to us in 2015.

Westwood is a 42,000 square foot tilt-up industrial building situated on top of 1.75 acres of industrial land which fronts the 15 freeway at Desert Inn Road. This building was sold to us early in the 2020 pandemic. The Seller was the original builder of the property.

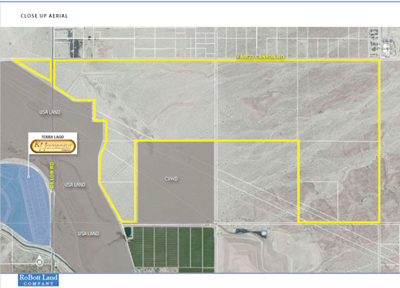

This property consists of 640 acres in Yucca Valley/Joshua Tree submarket. Seller was based in New England and was settling an estate which included a a dozen properties. We closed on this land in 2018 with a 10-day escrow.

This property included several producing oil wells, an Ideco workover rig, and 240 acres of fee simple land. The seller was retreating from California living. He moved to Tennessee. In additioan to continuing with the oil production the property is now under a long-term solar agreeement for an eventual 190-acre solar farm.